jersey city property tax calculator

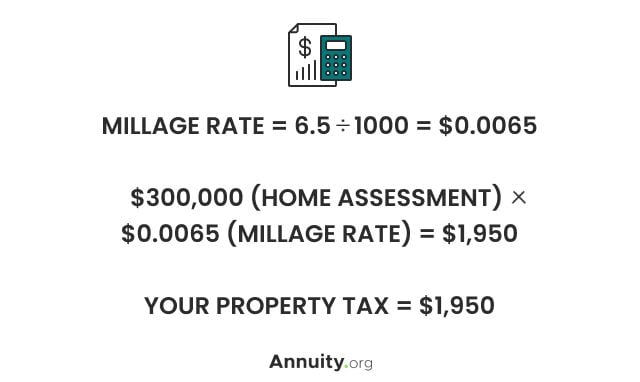

An individual taxpayers property taxes are calculated by multiplying the towns general tax rate by the assessed value of the taxpayers property. DEC 20 2020.

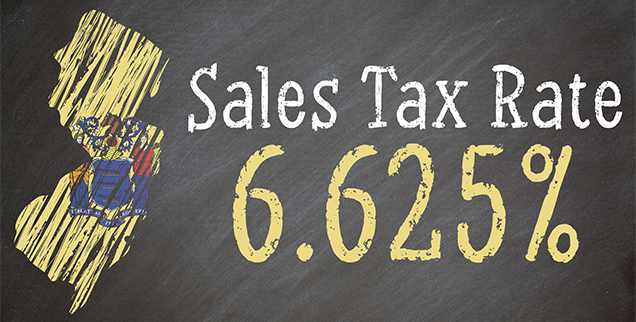

Nj Division Of Taxation Sales And Use Tax

City of Jersey City.

. Account Number Block Lot Qualifier Property Location 18 14502 00011 20 HUDSON. Box 2025 Jersey City NJ 07303. Enter a NJ Municipality.

Tax amount varies by county. New Jersey Income Tax Calculator 2021. The median property tax in New Jersey is 657900 per year for a home worth the median value of 34830000.

Left to the county however are appraising property issuing levies making collections enforcing compliance and resolving. Account Number Block Lot Qualifier Property Location 18 14502 00011 20 HUDSON. In New York City property tax rates are actually fairly low.

For comparison the median home value in Jersey County is. Customarily the New Jersey Transfer Tax is paid by the seller and the Mansion Tax on residential or commercial purchases of 1 million or more is paid by the buyer. Purchase Price Purchase Price is the only field required.

If you make 70000 a year living in the region of New Jersey USA you will be taxed 12783. 189 of home value. Office of the City Assessor.

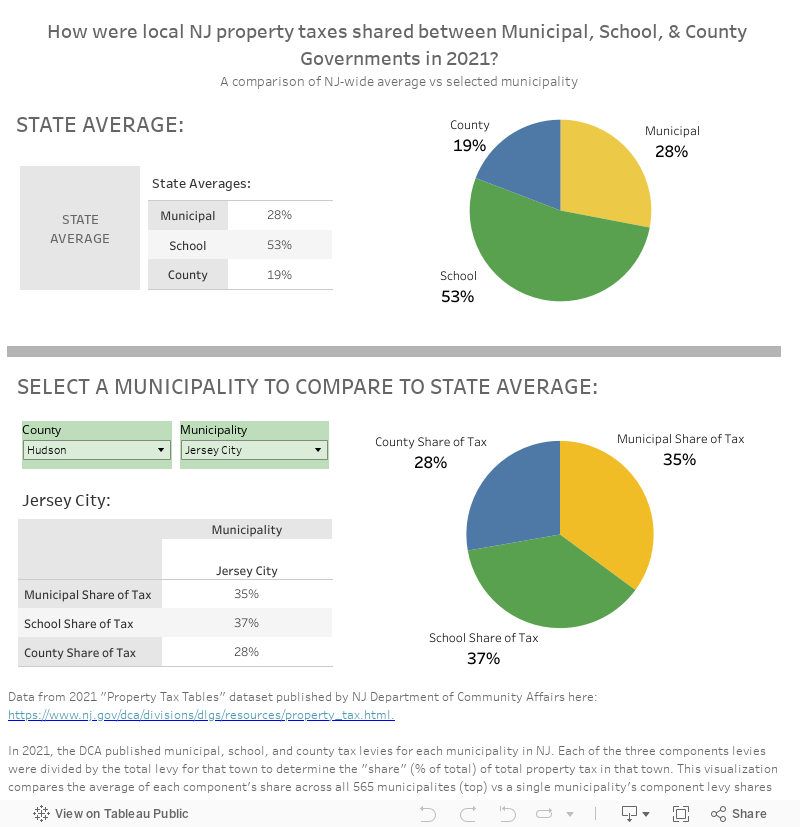

For comparison the median home value in New Jersey is. Useful Transfer Tax Links. Jersey City establishes tax levies all within the states statutory rules.

Online Inquiry Payment. To view Jersey City Tax Rates and Ratios read more here. NJ Transfer Tax Calculator.

Overview of New York Taxes. To use the calculator just enter your propertys current market value such as a current appraisal or a recent purchase price. Follow these simple steps to calculate your salary after tax in Jersey using the Jersey Salary Calculator 2022 which is updated with the 202223 tax tables.

TO VIEW PROPERTY TAX ASSESSMENTS. RTF-1 EE Affidavit of. New Jersey Transfer Tax.

Monday to Friday 830am to 5pm. The calculator will show you the total sales tax amount as well as the county city and special district tax rates in the selected location. Enter Your Salary and the Jersey.

New York Property Tax Calculator. To use the calculator just enter your propertys current market value such as a current appraisal or a recent purchase price. For comparison the median home value in Ocean County is.

Taxes enquiry desk at Customer and Local Services Philip Le Feuvre House La Motte Street St. Your average tax rate is 1198 and your marginal tax. Revenue Jersey tax T 01534 440300.

RTF-1 Affidavit of Consideration for Use by Sellers. Online Inquiry Payment. To use the calculator just enter your propertys current market value such as a current appraisal or a recent purchase price.

City of Jersey City.

Property Tax Rates Average Tax Bills And Home Assessments For Monmouth County New Jersey

Nj Property Tax Relief Program Updates Access Wealth

How Nyc Property Taxes Are Calculated Streeteasy

How To Estimate Property Taxes Turbotax Tax Tips Videos

Average Nj Property Tax Bill Rose Again In 2020 Nj Spotlight News

Real Estate Transfer Tax Calculator New Jersey

Property Taxes City Of Jersey City

Nj Property Taxes Have Been Rising At A Slower Pace Nj Spotlight News

U S Cities With The Highest Property Taxes

New Jersey 2022 Sales Tax Calculator Rate Lookup Tool Avalara

Jersey City Budgets The Connection To Property Tax Expense An Interactive Teaching Visual Civic Parent

Property Tax Calculator Estimator For Real Estate And Homes

The Official Website Of City Of Union City Nj Tax Department

Property Taxes Calculating State Differences How To Pay